As I'm writing this blog post on January 13, 2023, the year of 2022 is nearly two weeks behind us at this point.

Thus, I will be going over my dividend (and non-dividend) stock purchases for the final month of last year. Last month was my slowest for capital deployment in all of 2022 as I closed out the year by building my emergency fund up to just beyond six months of living expenses. Without further ado, let's dig into the few purchases that I made in December 2022.

My $153.67 in net dividends (regular dividends and special dividends less the $10 annual fee) received from the Capital Income Builder (CAIBX) mutual fund in my retirement account were automatically reinvested. This purchased 2.452 shares, which boosted my net annual forward dividends by $5.22 based on an annualized dividend per share of $2.13. That works out to a 3.40% net dividend yield.

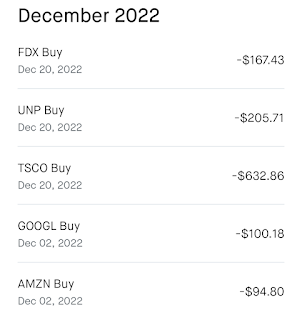

I started off the month in my taxable accounts by adding yet another share to my position in Amazon (AMZN) at a cost of $94.80. As I alluded to in a previous post a while back, AMZN is the leader in e-commerce and cloud computing. And while the stock doesn't pay a dividend right now, it almost certainly will in the next six or seven years.

On that same note, I increased my position in Alphabet (GOOGL) by a share for the price of $100.18. GOOGL is the dominant digital advertising company in the world. And like AMZN, I suspect that it will likely begin paying a dividend by the end of this decade.

My first dividend stock purchase for the month was when I opened a starter position of three shares in Tractor Supply (TSCO) at an average cost per share of $210.95. For readers interested in the rationale on why I made this stock purchase and the two that will follow, my December 2022 dividend stock watch list post can provide more details. This transaction added $11.04 to my net annual forward dividend income, which equates to a 1.74% net dividend yield.

The next dividend stock purchase that I completed in December was one share of Union Pacific (UNP) at a price of $205.71. This buy boosted my net annual forward dividends by $5.20, which is equivalent to a 2.53% dividend yield.

The third and final dividend stock purchase that I executed last month was one share of FedEx (FDX) at a cost of $167.43. This transaction increased my net annual forward dividends by $4.60, which works out to a 2.75% net dividend yield.

Concluding Thoughts:

I deployed $1,354.65 in capital during December 2022. These purchases lifted my net annual forward dividends higher by $26.06, which is a 1.92% weighted average net dividend yield.

Along with the $18.794 increase to my net annual forward dividends from dividend increases last month, this pushed my net annual forward dividends up to just below $3,355 heading into January 2023.

Discussion:

How was capital deployment in December 2022 for you?

Did you open any new positions like I did with TSCO?

I appreciate your readership and look forward to your comments below!

Hey, you will buy more Altria, also?

ReplyDeleteYes, MO doesn't look to shabby right now. I'm certainly planning on building out my position in MO for this year and beyond.

ReplyDelete