Tuesday, November 29, 2022

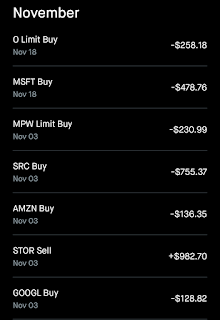

November 2022 Dividend Stock Purchases

Tuesday, November 22, 2022

Expected Dividend Increases for December 2022

Actual Dividend Increases for November 2022

Dividend Increase #1: Main Street Capital (MAIN)

Dividend Increase #2: Simon Property Group (SPG)

Dividend Increase #3: KeyCorp (KEY)

Dividend Increase #4: Aflac (AFL)

Dividend Increase #5: Merck (MRK)

Expected Dividend Increases for December 2022

Expected Dividend Increase #1: Union Pacific (UNP)

Expected Dividend Increase #2: Abbott Laboratories (ABT)

Expected Dividend Increase #3: Amgen (AMGN)

Expected Dividend Increase #4: American Tower (AMT)

Expected Dividend Increase #5: Broadcom (AVGO)

Expected Dividend Increase #6: Bristol Myers Squibb (BMY)

Expected Dividend Increase #7: CVS Health (CVS)

Expected Dividend Increase #8: Dominion Energy (D)

Expected Dividend Increase #9: Eastman Chemical (EMN)

Expected Dividend Increase #10: Realty Income (O)

Expected Dividend Increase #11: Pfizer (PFE)

Expected Dividend Increase #12: WEC Energy Group (WEC)

Expected Dividend Increase #13: W.P. Carey (WPC)

Expected Dividend Increase #14: Mastercard (MA)

Concluding Thoughts:

Discussion:

Tuesday, November 15, 2022

December 2022 Dividend Stock Watch List

Dividend Stock #1: Tractor Supply (TSCO)

Dividend Stock #2: FedEx (FDX)

Dividend Stock #3: Union Pacific (UNP)

Concluding Thoughts:

Discussion:

Tuesday, November 8, 2022

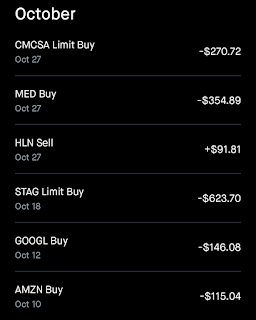

October 2022 Dividend Income

As I'm writing this blog post on Saturday, November 5, it is currently just 40 degrees Fahrenheit and raining. Over the next few days, temperatures here in Central Wisconsin will only reach into the low-50 degrees Fahrenheit. But at least that is meaningfully higher than the 40 degrees Fahrenheit average high for November.

Now that October 2022 is in the books, it is time to take a look at my net dividend income for the month. Spoiler alert: It was yet another record for the first month of the quarter.

I collected $204.57 in net dividends during October 2022. This equates to a 16.2% growth rate over the $176.10 in net dividends received in July 2022.

Compared to the $114.59 in net dividends that I collected in October 2021, this works out to a 78.5% year-over-year growth rate.

Digging deeper, I received $193.69 in net dividends from 27 stocks within my Robinhood portfolio. I also collected $10.71 in net dividends from five stocks in my Webull account. Finally, I received $0.17 in net dividends from eight stocks within my M1 Finance portfolio.

My net dividends were lifted by $28.47 from July 2022 to October 2022, which was the result of the following activity across my accounts:

I received an extra $6.02 in net dividends from JPMorgan Chase (JPM) in my Robinhood and M1 Finance portfolios, which was due to the timing of the dividend payment. This is because it is always paid at the end of the first month, but sometimes isn't reflected in my brokerage account until the day after.

My net dividends collected from American Tower (AMT) increased by $0.12 within my Robinhood account, which was the result of the 2.8% dividend increase in the quarterly dividend per share announced in September.

I received an additional $0.26 in net dividends from U.S. Bancorp (USB) in my Robinhood portfolio. That was due to the 4.3% bump in the quarterly dividend per share declared back in September.

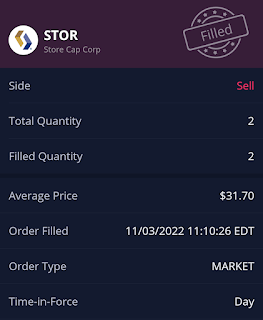

My net dividends collected from STORE Capital (STOR) were $0.82 higher within my Robinhood and Webull accounts, which was the result a 6.5% hike in the quarterly dividend per share in September.

I received an extra $0.02 in net dividends from W.P. Carey (WPC) in my Robinhood portfolio. This was due to the 0.2% increase in the quarterly dividend per share back in September.

My net dividends collected from Innovative Industrial Properties (IIPR) were $0.30 more than the prior quarter within my Robinhood account, which was the result of a 2.9% bump in the quarterly dividend per share.

I received an additional $0.12 in net dividends from Main Street Capital (MAIN) in my Robinhood portfolio. This was due to the 2.3% increase in its monthly dividend per share in August.

My net dividends collected from Philip Morris International were $4.07 higher than in the previous quarter within my Robinhood and Webull accounts. This was the result of a 1.6% raise in the quarterly dividend per share back in September and my purchase of three more shares during that month.

I received an extra $6.36 in net dividends from Altria Group (MO) in my Robinhood and Webull portfolios. This was due to a 4.4% increase in the quarterly dividend per share in August and my purchase of six shares back in June after the ex-dividend date.

My net dividends collected from Merck (MRK) were $2.07 higher within my Robinhood account, which was the result of my purchase of three more shares in July.

I received an additional $1.34 in net dividends from GlaxoSmithKline (GSK) in my Robinhood portfolio. This was due to the purchase of six more shares in June.

My net dividends collected from VICI Properties (VICI) were $3.87 more than in the prior quarter within my Robinhood account, which was the result of the dividend hike in September and my purchase of eight more shares in July.

I received an extra $3.10 in net dividends from Iron Mountain (IRM) in my Robinhood and Webull portfolios. This was due to my purchase of five more shares back in July.

Concluding Thoughts:

Discussion:

How did your dividend income fare in October 2022?

Did you receive any dividends for the first time during the month?

Thanks for reading. I look forward to your comments below!