Tuesday, October 31, 2023

Exciting Career News

Tuesday, October 24, 2023

Expected Dividend Increases for November 2023

As I'm writing this blog post, it is Monday, October 23, 2023. The temperature is currently 54 degrees Fahrenheit here in Central Wisconsin, which isn't bad for this time of year. That's why I plan on getting outside shortly to enjoy the days above freezing while we still have them.

Weather aside, the time of the month makes it a decent time to cover the dividend increases that have come my way so far this month. As of writing, I still expect three raises to come in over the next few days. Thus, I will update this post as necessary. Let's dig into those dividend hikes and look ahead to next month!

Actual Dividend Increases for October 2023

Dividend Increase #1: A.O. Smith (AOS)

A.O. Smith announced a 6.7% increase in its quarterly dividend per share to $0.32, which was just below my estimate of a raise to $0.33. But I don't mind a conservative raise from AOS.

Across my 12 shares of AOS, my net annual forward dividends grew by $0.96 due to this dividend announcement.

Dividend Increase #2: Energy Transfer (ET)

Energy Transfer declared a 0.8% raise in its quarterly distribution per unit to $0.3125. That was precisely what I expected.

My net annual forward distributions rose by $0.86 across my 86 units of ET as a result of this distribution declaration.

Dividend Increase #3: Lockheed Martin (LMT)

Lockheed Martin announced a 5% bump in its quarterly dividend per share to $3.15, which was less than my forecast of $3.20. However, I will still take the raise!

Across my four shares of LMT, my net annual forward dividends climbed by $2.40 due to this dividend announcement.

Dividend Increase #4: McDonald's (MCD)

McDonald's declared a 9.9% raise in its quarterly dividend per share to $1.67. That's better than the $1.63 that I was expecting, which is why I'm lovin' MCD's dividend.

My net annual forward dividends grew by $1.80 across my three shares of MCD as a result of this dividend declaration.

Dividend Increase #5: Pinnacle West Capital (PNW)

Pinnacle West Capital announced a 1.7% increase in its quarterly dividend per share to $0.88, which was what I anticipated.

Across my seven shares of PNW, my net annual forward dividends inched higher by $0.42 due to this dividend announcement.

Dividend Increase #6: Tanger Factory Outlet Centers (SKT)

Tanger Factory Outlet Centers declared a 6.1% increase in its quarterly dividend per share to $0.26. That was just below my prediction of $0.265.

My net annual forward dividends grew by $0.66 across my 11 shares as a result of this dividend declaration.

Dividend Increase #7: AbbVie (ABBV)

AbbVie hasn't yet announced its dividend increase. But since they will be releasing Q3 earnings this Friday (Oct. 27), I would expect the 4.1% raise to $1.54 to go through by that time.

Across my 14 shares of ABBV, my net annual forward dividends would surge $3.36 higher from such an announcement.

UPDATE: ABBV announced a 4.7% increase in its quarterly dividend per share to $1.55. Across my 14 shares, this lifted my net annual forward dividends by $3.92 due to the announcement.

Dividend Increase #8: Exxon Mobil (XOM)

Exxon Mobil will also be releasing its Q3 earnings on Friday. This is when I anticipate a 4.4% increase in its quarterly dividend per share to $0.95 will be declared.

My net annual forward dividends would rise by $1.76 across my 11 shares of XOM due to such a dividend declaration.

UPDATE: XOM declared a 4.4% increase in its quarterly dividend per share to $0.95 as I expected. My net annual forward dividends grew by $1.76 across my 11 shares of XOM as a result of the declaration.

Dividend Increase #9: Visa (V)

Visa will be sharing earnings results for its fiscal Q4 tomorrow. That's when I believe V will announce a 16.7% hike in its quarterly dividend per share to $0.525.

Across my seven shares of V, my net annual forward dividends would grow by $2.10 from such an announcement.

UPDATE: V announced a 15.6% boost in its quarterly dividend per share to $0.52. Across my seven shares of V, my net annual forward dividends rose by $1.96 due to the announcement.

Dividend Increase #10: American Electric Power (AEP)

I am reiterating my expectation of a 6% boost in the quarterly dividend per share to $0.88 from American Electric Power.

UPDATE: AEP declared a 6% increase in its quarterly dividend per share to $0.88. My net annual forward dividends grew by $3 across my 15 shares of AEP as a result of the declaration.

Dividend Freeze: Crown Castle International (CCI)

Crown Castle International kept its quarterly dividend per share in line at $1.565. Considering the higher churn that the company is dealing with stemming from the T-Mobile and Sprint merger, this is okay with me. Management is committed to keeping the dividend the same in 2024 and expects growth to resume in 2025 and beyond.

Expected Dividend Increases for November 2023

Expected Dividend Increase #1: Automatic Data Processing (ADP)

The first dividend hike that I'm expecting will come from Automatic Data Processing (ADP). My best guess is that ADP will declare a 10.4% raise in its quarterly dividend per share to $1.38.

My net annual forward dividends would rise by $3.64 if this prediction plays out across my seven shares of ADP due to such a declaration.

Expected Dividend Increase #2: Aflac (AFL)

The third dividend increase that I'm predicting for next month will come from Aflac. I believe AFL will declare a 4.8% raise in its quarterly dividend per share to $0.44.

My net annual forward dividends would rise by $0.88 across my 11 shares of AFL due to such a declaration.

Expected Dividend Increase #3: Main Street Capital (MAIN)

The next dividend raise that I expect in November is from Main Street Capital. My best guess is that MAIN will announce a 2.1% increase in its monthly dividend per share to $0.24.

Across my 30 shares of MAIN, my net annual forward dividends would surge higher by $1.80 from such an announcement.

Expected Dividend Increase #4: Merck (MRK)

The fifth dividend bump that I'm predicting for next month will come from Merck. I believe that MRK will declare a 5.5% increase in its quarterly dividend per share to $0.77.

My net annual forward dividends would grow by $1.76 across my 11 shares of MRK due to such a declaration.

Expected Dividend Increase #5: Simon Property Group (SPG)

The final dividend raise that I expect in November is from Simon Property Group. My guess is that SPG will announce a 2.6% bump in its quarterly dividend per share to $1.95.

Across my nine shares of SPG, my net annual forward dividends would rise by $1.80 from such an announcement.

Concluding Thoughts:

I received $17.74 in dividend increases from 10 companies in October. That would be like investing $591.33 in fresh capital at a 3% dividend yield.

In November, I expect to get a $9.88 boost in net annual forward dividends from raises. This is equivalent to investing $329.33 at a 3% yield.

Discussion:

How was your October for dividend declarations?

Did you receive any first-time raises during the month?

As usual, I appreciate your readership and look forward to your comments below!

Tuesday, October 17, 2023

An Update To The Blog's Posting Schedule

As I'm writing this blog post on Friday, October 13, it is just 46 degrees Fahrenheit and raining here in Central Wisconsin. Damp and cold weather is an excellent indication that fall is here and winter isn't far behind.

With that aside, I wanted to update readers on a change to my writing schedule for this blog for at least the foreseeable future.

I Am Pausing The Monthly Stock Watch List Blog Post (For Now)

Readers familiar with this blog may be aware of my monthly stock watch list blog posts. These are where are highlight three stocks that are on my watch list for each month. I didn't highlight any stocks that were on my watch list for October 2023 for the following reasons:

1) My recent job loss prompted me to strive to boost my emergency fund from three months to around six months by the end of this year. Thus, I likely won't be investing enough capital to justify writing these blogs until early next year.

2) My schedule is also a bit busier as I adjust to my new role (more on that to come in a later blog post).

All Other Blog Posts Will Continue

Concluding Thoughts:

Discussion:

Tuesday, October 10, 2023

September 2023 Dividend Income

As I'm writing this blog post on Friday, October 6, it is currently 52 degrees Fahrenheit here in Central Wisconsin. The foreseeable future is going to be stuck in the 50 degrees Fahrenheit range, which makes it a bit less pleasurable to be outside. But it's still doable.

With that aside, the month of September is about a week in the books. That makes now a good time to look at my dividend income for the month.

Compared to the $343.64 in net dividends that I received in September 2022, this works out to a 26.5% year-over-year growth rate.

Sparing the painstaking details of every component that led my dividend income higher, I will simply go over an overview of each of my accounts moving forward with this series.

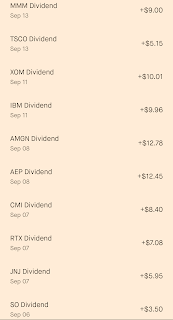

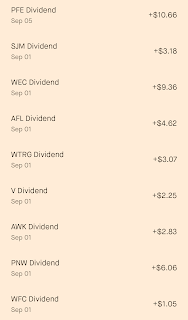

I collected $337.10 in net dividends from 47 companies in my Robinhood account. This was including a the relatively routine special dividend that is paid by Main Street Capital in the end month of each quarter. The oddity of the month within this portfolio was the $3.96 special distribution paid by Magellan Midstream Partners in relation to its deal with ONEOK (OKE) as I explained in my previous blog post. Otherwise, the biggest contributor to my increased dividend income was my purchase of 30 shares of Brookfield Asset Management (BAM) in August.

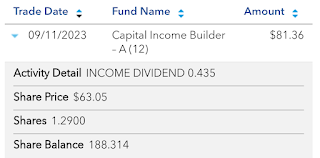

Next, I received $81.36 in net dividends from my Capital Income Builder (CAIBX) mutual fund within my retirement portfolio from a previous employer. This was slightly more due to my higher share count from dividend reinvestment.

I also collected $15.88 in net dividends from six companies in my Webull account. This was slightly higher due to the dividend hike from UnitedHealth Group (UNH) announced in June.

Finally, I received $0.51 in net dividends from 23 companies within my M1 Finance portfolio. The timing of PepsiCo's (PEP) dividend more than offset the extra $0.01 from Hershey (HSY) from its dividend raise declared back in July.

Concluding Thoughts:

Another month has concluded and the dividend portfolio is steadily growing. Since my capital deployment will be minimal for the foreseeable future as I build up my emergency fund, dividend reinvestment and dividend raises are going to have to carry me for at least the rest of this year.

Discussion:

How was your dividend income during September 2023?

Did you receive any first-time dividends last month as I did with BAM?

Thanks for your readership and please feel free to comment below!