As I'm writing this blog post on Friday, October 6, it is currently 52 degrees Fahrenheit here in Central Wisconsin. The foreseeable future is going to be stuck in the 50 degrees Fahrenheit range, which makes it a bit less pleasurable to be outside. But it's still doable.

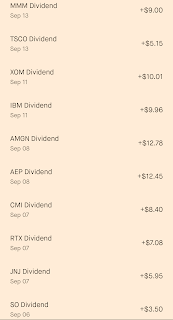

With that aside, the month of September is about a week in the books. That makes now a good time to look at my dividend income for the month.

Compared to the $343.64 in net dividends that I received in September 2022, this works out to a 26.5% year-over-year growth rate.

Sparing the painstaking details of every component that led my dividend income higher, I will simply go over an overview of each of my accounts moving forward with this series.

I collected $337.10 in net dividends from 47 companies in my Robinhood account. This was including a the relatively routine special dividend that is paid by Main Street Capital in the end month of each quarter. The oddity of the month within this portfolio was the $3.96 special distribution paid by Magellan Midstream Partners in relation to its deal with ONEOK (OKE) as I explained in my previous blog post. Otherwise, the biggest contributor to my increased dividend income was my purchase of 30 shares of Brookfield Asset Management (BAM) in August.

Next, I received $81.36 in net dividends from my Capital Income Builder (CAIBX) mutual fund within my retirement portfolio from a previous employer. This was slightly more due to my higher share count from dividend reinvestment.

I also collected $15.88 in net dividends from six companies in my Webull account. This was slightly higher due to the dividend hike from UnitedHealth Group (UNH) announced in June.

Finally, I received $0.51 in net dividends from 23 companies within my M1 Finance portfolio. The timing of PepsiCo's (PEP) dividend more than offset the extra $0.01 from Hershey (HSY) from its dividend raise declared back in July.

Concluding Thoughts:

Another month has concluded and the dividend portfolio is steadily growing. Since my capital deployment will be minimal for the foreseeable future as I build up my emergency fund, dividend reinvestment and dividend raises are going to have to carry me for at least the rest of this year.

Discussion:

How was your dividend income during September 2023?

Did you receive any first-time dividends last month as I did with BAM?

Thanks for your readership and please feel free to comment below!

No comments:

Post a Comment