As I'm writing this blog post on Oct. 28, the temperature is expected to reach a high of 61 degrees Fahrenheit here in Central Wisconsin. And the weather will be just as warm over the next few days. That's why I plan on definitely getting outside this weekend!

Weather aside, I have made all of the dividend stock purchases that I plan on making for this month. Thus, I will be detailing my dividend stock purchases for the month of October 2022.

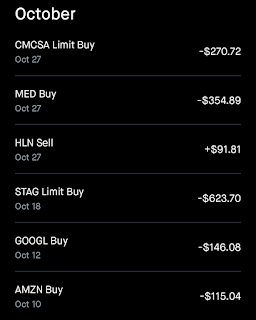

As I did in September and in the months prior, I added to my position in the non-dividend stock, Amazon (AMZN). I purchased a single share of the stock at a cost of $115.04.

I also boosted my stake in the other non-dividend stock in my portfolio, which is Alphabet (GOOGL). I acquired another 1.5 shares in GOOGL at an average cost of $97.39 a share.

My first dividend stock purchase during the month was 21 shares of STAG Industrial (STAG) at an average price per share of $29.70. As I alluded to in my October 2022 Dividend Stock Watch List post, STAG is a high-yielding real estate investment trust with a safe dividend. The company also is steadily growing and trading at a cheap valuation. This dividend stock purchase added $30.66 to my net annual forward dividend income, which equates to a 4.87% net dividend yield.

My only sale for the month was 15 shares of Haleon (HLN) at an average price of $6.12 a share. HLN is the consumer health division that was recently spun-off from GlaxoSmithKline (GSK), which will eventually pay out 30% to 50% of its profits via a dividend. While the company has a solid brand portfolio, I feel as though I already have a strong enough bench of consumer staples.

My next dividend stock purchase during October was three shares of Medifast (MED) at an average cost per share of $118.30. Like STAG, this was also on my watch list for the month. The $19.68 boost in net annual forward dividends by this transaction is equivalent to a 5.55% weighted average yield.

The third and final dividend stock purchase was Comcast (CMCSA), which was also on my watch list for October. I added eight shares of the stock to my portfolio at an average cost of $33.84 a share. This buy added $8.64 in net annual forward dividends to my portfolio, which works out to a 3.19% net dividend yield.

Concluding Thoughts:

Excluding my sale of HLN, I deployed $1,418.62 of capital during the month. This equates to a weighted average net yield of 4.16%.

I also received a $25.12 boost in annual net forward dividends via dividend increases during the month. My net annual forward dividends surged from just over $3,175 heading into the month to just over $3,260 by the end of the month.

Discussion:

How was your capital deployment for the month?

Did you open any new positions in October 2022 as I did with my purchase of STAG?

Thank you for reading. Please feel free to comment below!

Great job again Kody! Especially with maintaining your consistent purchases and that's awesome seeing you pushing up near $3,200. October was a bit on slower side for our purchases, but luckily reinvestment and increases helped to push us higher and pick up the slack a bit.

ReplyDeleteThanks for the comment. Gotta love it when dividend reinvestment and purchases come in clutch during a slow purchase month. Keep it up!

ReplyDelete