As I'm writing this blog post, it's hard to believe that the end of the first month of 2023 is already almost upon us. After weeks of warmer than average weather, it is certainly feeling like January again here in Central Wisconsin: The low temperature for today (Friday, January 27, 2023) will be a frigid 8 degrees Fahrenheit.

Earlier this month, I alluded to my net dividend income for December 2022. But let's use this blog post as an opportunity to dig deeper into the figure.

During the month of December 2022, I received $423.00 in net dividends. Compared to the $343.64 in net dividends that I collected in September 2022, this is a 23.1% quarterly growth rate.

Put up against the $353.38 in net dividends that I received in December 2021, my net dividend income surged 19.7% higher over the year-ago period.

Breaking my net dividends down by account, I collected $253.60 in net dividends from 44 stocks in my Robinhood account. My net dividends received from the Capital Income Builder (CAIBX) mutual fund within my retirement portfolio was $153.67 (after including the $10 annual fee charged during the month). I collected $15.25 in net dividends from six stocks in my Webull account. Finally, I received $0.48 in net dividends from 22 stocks within my M1 Finance portfolio.

The $79.36 increase in my net dividends collected from September 2022 to December 2022 was the result of the following activity in my investing accounts:

My net dividends received from Broadcom (AVGO) were $1.50 higher within my Robinhood and Webull portfolios. This was due to the 12.2% hike to the quarterly dividend per share last month.

I collected an extra $0.38 in net dividends from Crown Castle International (CCI) in my Robinhood account, which was the result of a 6.5% boost to the quarterly dividend per share in October.

My net dividends received from Lockheed Martin (LMT) were $0.80 more within my Robinhood and Webull portfolios. This was due to the 7.1% increase in the quarterly dividend per share back in September.

I collected an additional $0.45 in net dividends from Simon Property Group (SPG) in my Robinhood account, which was thanks to the 2.9% lift in the quarterly dividend per share last November.

My net dividends received from Main Street Capital (MAIN) were $0.12 higher within my Robinhood portfolio. This was due to the 2.3% increase in the monthly dividend per share announced in November.

I collected an extra $0.42 in net dividends from McDonald's (MCD) in my Robinhood account, which was the result of the 10.1% raise in the quarterly dividend per share last October.

My net dividends received from Realty Income (O) were an extra $1.00 within my Robinhood portfolio. This was due to my purchase of four more shares in November and the 0.2% dividend increase last month.

I collected an additional $4.40 in net dividends from Coca-Cola (KO) in my Robinhood account, which was because the timing of the dividend payment.

My net dividends received from KeyCorp (KEY) were $0.39 higher within my Robinhood portfolio. That was due to the 5.1% raise in the quarterly dividend per share in November.

I collected an extra $2.56 in net dividends from STAG Industrial (STAG) in my Robinhood account, which was the result of my purchase of 21 shares in October.

My net dividends received from Exxon Mobil (XOM) within my Robinhood and M1 Finance portfolios were $0.34 greater. This was due to the 3.4% raise in the quarterly dividend per share declared in October.

I collected an additional $0.55 in net dividends from American Electric Power (AEP) in my Robinhood account, which was the result of the 6.4% raise announced last October.

My net dividends received from Microsoft (MSFT) were $0.18 higher within my Robinhood portfolio. This was due to the 9.7% dividend hike announced in September.

I collected an extra $0.37 in net dividends from Visa (V) in my Robinhood and Webull accounts, which was the result of the 20% boost to the quarterly dividend per share declared last October.

My net dividends received from Pinnacle West Capital (PNW) within my Robinhood portfolio were $0.11 more. This was due to the 1.8% dividend increase announced in October.

I collected an additional $77.73 in net dividends from my CAIBX mutual fund in my retirement account during the month, which due to a higher share count and the special dividend payment.

My net dividends received from PepsiCo (PEP) were $4.62 less within my Robinhood and M1 Finance portfolios. This was the result of the timing of the dividend payment.

I also collected $7.32 less in net dividends from Digital Realty Trust (DLR) in my Robinhood account, which was due to the dividend payment's timing.

Concluding Thoughts:

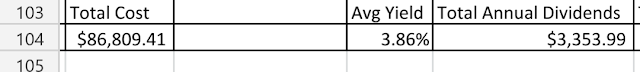

As I continue to deploy between $3,000 and $3,500 in capital each month and I receive more dividend hikes from my holdings, my portfolio should really pick up steam in 2023 and beyond. In fact, I anticipate that March 2023 will probably be my final end-of-quarter month with net dividend income under $400.

Discussion:

How was your dividend income last month?

Did you receive any first-time dividends in December 2022?

Thanks for reading and please feel free to comment below!