Since the month of September is basically over, now is a good time to go over the dividend stock purchases for the month. Given that I recently lost my position at The Motley Fool and I would like to build up my emergency fund, I didn't deploy any of my own capital this month. Let's dig in.

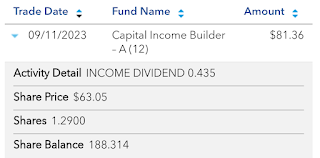

Starting with my retirement account, I reinvested $81.36 in dividends from my Capital Income Builder (CAIBX) mutual fund. This increased my position by 1.29 shares at an average cost per share of $63.07. The resulting $2.75 lift in my net annual forward dividends equates to a 3.38% net dividend yield.

Thanks to the recent action that ONEOK (OKE) took to buy all units of Magellan Midstream Partners (MMP) in an $18.8 billion deal, my direct position in MMP is no more. My 16 units of MMP were exchanged for 10.672 shares of the new OKE and $403.96 in cash from OKE's $25 per unit cash payment and MMP's special distribution per unit of $0.2474. I took the proceeds from this deal and redeployed them into another 6.328 shares of new OKE at an average cost per share of $63.64. These actions boosted my net annual forward dividends by $64.94.

I lost $67.04 in net annual forward distributions from the closing of my position in MMP, so this corporate action lowered my net annual forward dividends by $2.10. But the new OKE is going to be an absolute force to be reckoned with in many ways, so I view this as an overall positive.

Concluding Thoughts:

My net annual forward dividends edged $0.65 higher from dividend stock purchases and the like during the month of September.

Fortunately, my portfolio worked harder than I did to make me richer for the month. Due to the $16.906 in dividend increases that I received during the month, my net annual forward dividends climbed from just shy of $4,210 to start September to nearly $4,230 heading into October.

Discussion:

How was your capital deployment in September 2023?

Did you start any new positions during the month?

I appreciate your readership and welcome your comments below!

No comments:

Post a Comment