As I'm writing this blog post, it's November 25th. The high temperature for today is expected to reach 41 degrees Fahrenheit here in Central Wisconsin. And tomorrow will top 49 degrees Fahrenheit. Needless to say, I'm thrilled with these temperatures for this time of the year.

Aside from the weather, the time of the month means that I am done with my dividend stock purchases for the month of November 2022. Therefore, I will be going over the purchases that I made this month.

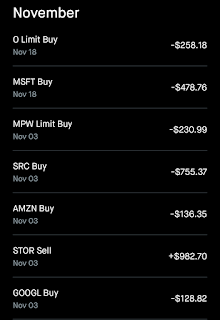

I started off the month of November by adding 1.5 shares of Alphabet (GOOGL) to my portfolio at an average cost per share of $85.88. As I indicated a couple of posts ago in this series, I like GOOGL for its strong market share in digital advertising. And I eventually believe that GOOGL will be a legendary dividend payer.

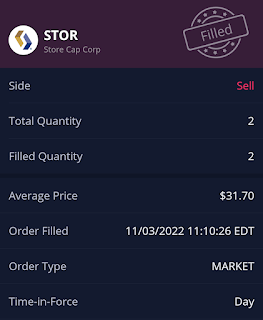

My first and only stock sale during the month was when I closed my 33 share position in STORE Capital (STOR) across my Robinhood and Webull accounts. This brought in $1,046.05 of capital proceeds, but I lost $54.12 in net annual forward dividends from the sale. It's really a shame that STOR will be sold to Oak Street because it's a classic example of a buy and hold business.

With the proceeds from my sale of STOR, I opened a 20 share position in Spirit Realty Capital (SRC) at a cost of $37.77 a share. This transaction added $53.04 to my net annual forward dividends, which works out to a net dividend yield of 7.02%. I was drawn to SRC because it is a fairly comparable business relative to STOR in terms of quality. The high-yield is well covered and I believe the dividend will grow in the mid-single-digits annually over the long haul.

I also used the proceeds from my sale of STOR to add 21 shares to my stake in Medical Properties Trust (MPW) at an average cost per share of $11.00. This purchase boosted my net annual forward dividends by $24.16, which is equivalent to a 10.46% weighted average dividend yield. MPW was on my November 2022 watch list because of its well-covered and high-yielding dividend and cheap valuation.

My next purchase was 1.5 shares of Amazon (AMZN) at a cost per share of $90.90. Similar to GOOGL, I believe that AMZN's dominance in cloud computing and e-commerce will eventually lead to a generous dividend policy from the company.

I added two shares of Microsoft (MSFT) to my portfolio at an average cost of $239.38 a share. This transaction bumped up my net annual forward dividends by $5.44, which is a 1.14% net dividend yield. As I explained in my November 2022 dividend stock watch list post, MSFT is a wonderful growth stock trading at a fair valuation. This was the logic behind my purchase decision.

My final dividend stock purchase of the month was four shares of Realty Income (O) at a cost per share of $64.54. As was the case with MPW and MSFT, O was on my watch list for the month. This transaction increased my net annual forward dividends by $11.904, which equates to a 4.61% dividend yield.

Concluding Thoughts:

Factoring out my sale of STOR, I deployed $942.42 in capital during November 2022. Given the $40.424 in net annual forward dividends that I added through purchases for the month, the weighted average dividend yield on my investments was 4.29%.

Discussion:

How was your November 2022 for capital deployment?

Thanks for reading and feel free to comment below!

No comments:

Post a Comment